What a year it has been! I think it’s safe to say that none of us anticipated or expected 2020 to deliver a global pandemic, in addition to a myriad of other unexpected events. As we head into the last few months of the year, we are taking the opportunity to look back at 2020 so far to see what impact the pandemic has had on the ebook market. The data presented below is based on reader engagement and purchase data from Bargain Booksy.

Bargain Booksy promotes books priced between $0.99 and $5 to an audience of over 300,000 readers. The large sample set and the ability to parse sales data (we don’t have sales data when books are free) makes it a reasonable yardstick for trend exploration.

How has Reader behavior changed?

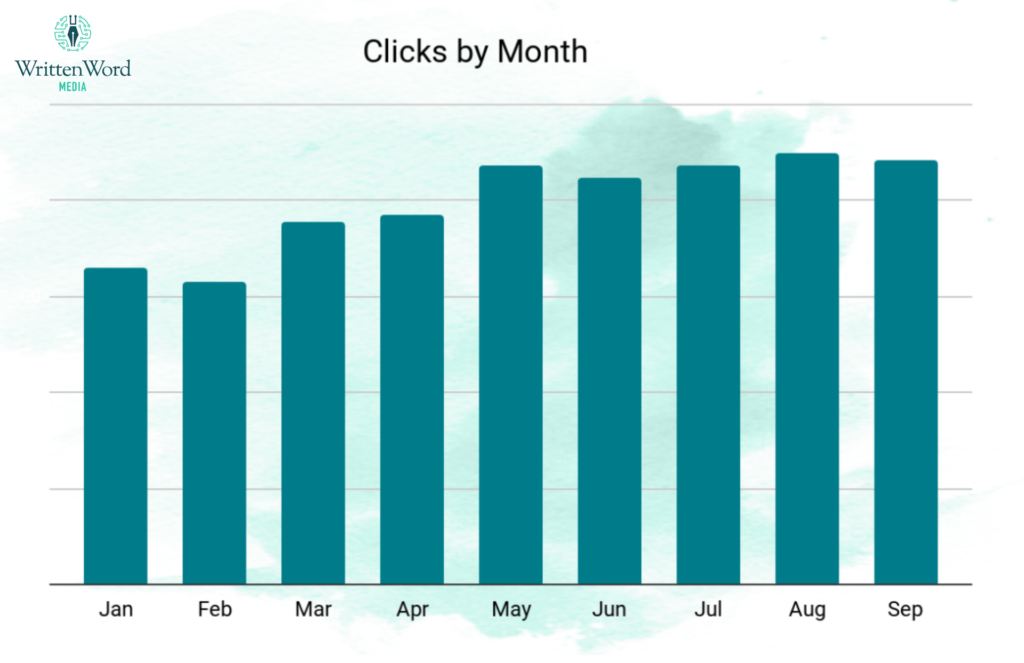

An immediate impact at the onset of the pandemic was an increase in overall reader engagement. As people across the world were locked down in their homes, they turned to ebooks for entertainment. Below we can see that email clicks have grown by 34% in 2020. (Numbers are reported in aggregate and are not smoothed for 30 and 31 day months). We work hard at Written Word Media to grow our lists and increase our clicks so not all of this growth is attributable to Covid. However, we have seen greater than average click growth so we know that Covid is playing a role here.

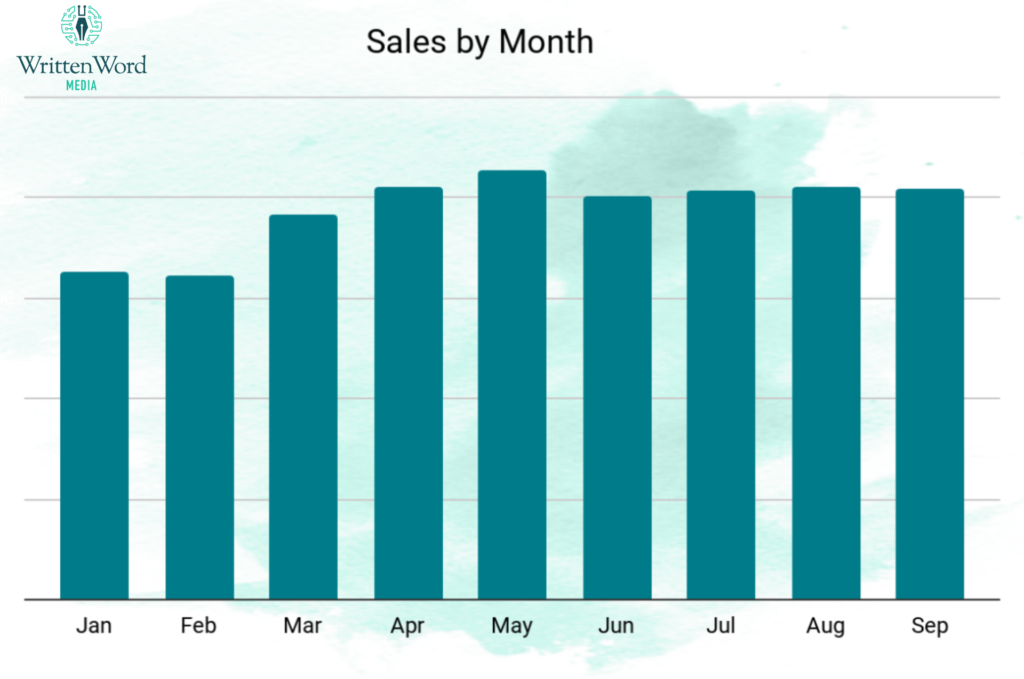

Physical books became sidelined initially due to bookstores being closed, and shipping delays from online retailers. eBook sales surged as readers turned to convenient and immediate delivery. Kindle sales on Bargain Booksy grew by 18% in March, and have remained elevated at approx. 25% above January levels.

When looking at individual readers, we find that an average reader is purchasing 30% more in ebooks units per month than in pre-pandemic times. This makes sense as people are stuck at home and spending less on travel and eating out. eBooks are an affordable form of entertainment.

What are People Reading?

The following genres have seen the largest uptick in sales:

-

- Cookbooks and Nutrition (+59%)

- Travel (+33%)

- Romance (+23%)

- Young Adult (+22%)

- Thriller (+15%)

- Mystery (+13%)

Most other genres, not on the above list, saw an increase of 0%-10%. There were only 3 genres that saw a slight decline in sales and they were Children’s, Science Fiction, and Literary Fiction.

What is the impact on pricing and the demand curve?

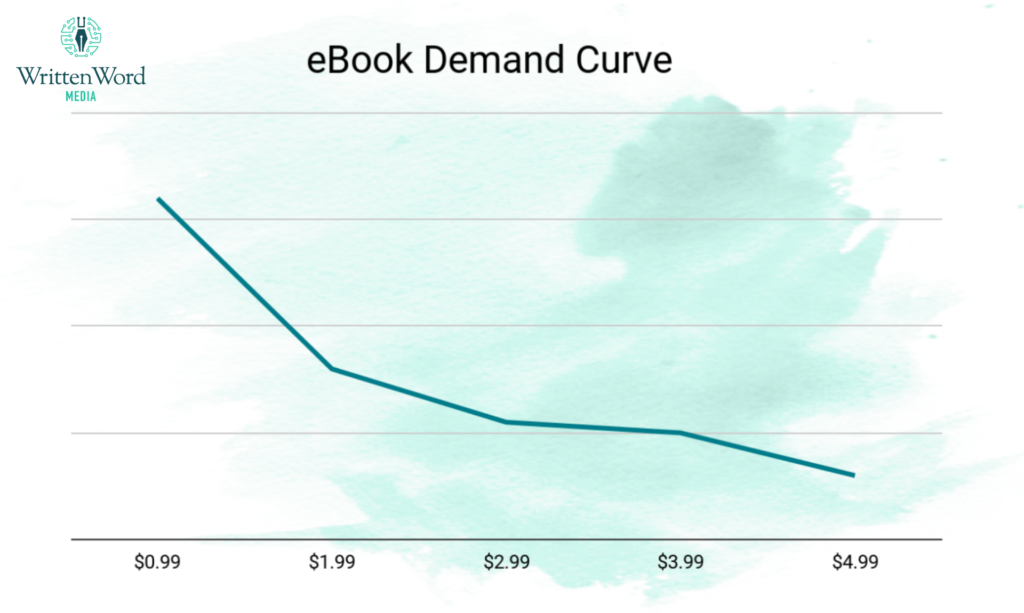

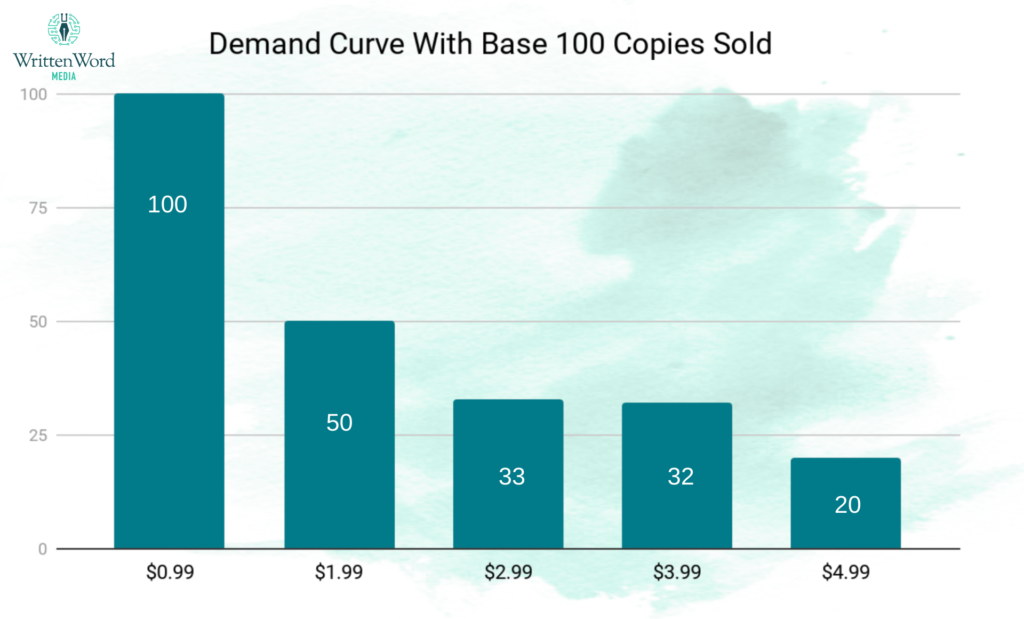

We were curious to see if there was any impact on the demand curve in 2020. We took a deep-dive into the number of copies sold at different price points. We found that the demand curve has not changed dramatically during COVID. The demand curve that we track is for books priced $0.99 to $4.99. Our guess is that traditionally published books that are priced in the $9.99 to $14.99 range likely saw a bigger impact to the demand curve given the higher starting prices.

Let’s take a look at the demand curve. As usual, $0.99 sells the most books. Demand drops by half when the price moves up from $0.99c to $1.99. Copies moved drops a further 33%-35% when you move from $1.99 to $2.99 or $3.99. We see a final drop of another 38% when you move to $4.99.

Here’s a look at the demand curve in copies moved if we assume a starting base of 100. So, if we assume that we would sell 100 books at $0.99, you can see how many books you would sell at $1.99, $2.99 etc.

When deciding on how to price their books, most authors will take into account additional factors such as the total royalty earned, readers reached, and series economics. For help on how to price your book, check out our article here.

When looking at the demand curve by genre, we found that Steamy Romance was the most price-sensitive genre, perhaps due to the competitive nature of the genre. For Steamy Romance authors, $0.99 was the most compelling price point. We also found a few genres that were slightly less price-sensitive when the price moved from $0.99 to $1.99. These genres were:

-

- Sweet Romance

- Mystery

- Erotic Romance

- Fantasy

- Non-Fiction (Self Help, Travel, Religion)

Non-Fiction genres were less price-sensitive up to the 2.99 price point, demonstrating a willingness by readers to spend more on this category of books.

What about the KU in the Room?

Beginning in May 2020, Amazon expanded the Kindle Unlimited trial period to a two-month free trial. The extended trial period was available to anyone signing up for Kindle Unlimited through June 2020. So if a reader signed up on June 30th, they had free access to Kindle Unlimited until August 31st. Amazon does not report on Kindle Unlimited stats, but there are two data points that point to an increase in KU membership and readership.

The KDP Global Fund size has increased by 16.0% from January 2020 to September 2020. When looking at the same time period in 2019, the KDP Global Fund only increased 4.9%. That means that the Global Fund grew three times faster in 2020 vs the prior year. If we assume that the size of the fund is a reflection of KU membership, it appears that KU membership grew more rapidly in 2020.

The second data point we found interesting is that the overall conversion rate on books featured in the Bargain Booksy email dropped starting in May (when the 2-month trial was announced and marketed). The conversion rate drops remained slightly lower every month through August 2020 (when the 2-month trials ends for everyone). In September we see the conversion rate climbing again. This could indicate that readers on our list who previously would have purchased an ebook, were instead borrowing ebooks through their KU free trial. It is important to note that despite the small drop in conversion rate, the overall ebook market pie grew bigger in 2020. So, total purchases of ebooks increased on Bargain Booksy, in addition to an overall increase in borrowing behavior.

What comes next?

2020 has been a good year for the ebook market. The largest increase in demand and ebook sales came in Q2. Although growth in Q3 slowed, overall sales are still well-above pre-pandemic levels. There are a few macro headwinds as we head into the last quarter of the year: Holidays, the US elections and consumer mindset.

Headwinds

The US election takes place on November 3rd of this year. The elections are top of mind for many Americans this year and may result in readers consuming more news content and less ebook content.

The Holiday shopping season is starting even earlier than usual as online retailers attempt to pull demand forward so they can handle the increased shipping volumes that 2020 will bring. Amazon’s delayed Prime Day, which ran on October 13th and 14th, has been widely viewed as the Holiday shopping kickoff week. In years past, Black Friday was viewed as the beginning of the Holiday Shopping period. So it looks like the shopping season will begin 6 weeks earlier than usual.

Lastly, many Americans received government stimulus checks in Q2 to offset economic hardship caused by the pandemic. As hopes for a second round of stimulus dwindles, many Americans are saving more and spending less.

Tailwinds

There are also some tailwinds that could continue to bolster the ebook market: less travel, the continued need for affordable at-home entertainment, and easy gifting.

Due to the pandemic, fewer readers will be traveling this Holiday season. Those staying home or close to home will suffer less Holiday distraction and will be looking for ways to entertain themselves. Books provide a comforting and proven source of affordable entertainment.

eBooks also provide a thoughtful and convenient gift to family and friends. These trends could make the case that authors who continue to price their books under $5 are likely to see the sales trends of 2020 continue into Q4.

If 2020, has taught us anything, it’s that the future is hard to predict. But it’s also fun to try. What do you think the last quarter of the year has in store for authors? Have you see these ebook market trends reflected in your writing business?

Very encouraging for me.

How have ebook sales compared to print book sales this year?

Your words of encouragement and support are of great value to me. They are of considerable significance to me about their obligations.

Wow, this is a super interesting look at how the pandemic boosted the ebook market! I totally get the spike in cookbook sales – baking was definitely my coping mechanism. Good to know I wasn’t alone!

Wow, super interesting how the pandemic boosted ebook sales! It’s cool to see which genres got a bump. Makes sense that people were cooking and dreaming of travel while stuck at home. Pretty neat!

You’re absolutely right – 2020 has been completely unpredictable! I’ve definitely noticed my own reading habits changed dramatically during lockdown. I found myself gravitating toward escapist fiction and comfort reads rather than my usual non-fiction. It’s fascinating to see actual data backing up what many of us experienced personally. I’m curious if the trend toward affordable ebooks will continue post-pandemic or if it was just a temporary shift during uncertain times.

Wow, interesting insights into the ebook market during the pandemic! Cookbooks and travel books saw a big jump! It’s amazing how people adapted. Makes you wonder what the future holds. Maybe I’ll use a tool like nano banana to jazz up my own ebook cover.

wooo very informative thanks for sharing